CORA

CORA, the Colorado Open Records Act, requires most public records to be available to the public. Anyone can request information that is in the possession of a government office, including the Secretary of State’s office.

PURA adopts these procedures to govern the inspection and copying of PURA records by any person under CORA. These procedures are designed to ensure compliance with CORA, to respond to requests in a consistent manner, and to protect against disclosure of information or documents that are confidential under Colorado law. Any response to a CORA request will be under the supervision of the PURA Executive Director.

View Colorado Open Records Act (PDF)

How Does Urban Renewal Benefit Pueblo Communities?

Every redevelopment project undertaken with the help of public investment positively impacts the community. Besides the elimination of blight, redevelopment brings a variety of benefits to the public and especially to the neighborhoods in which a project is undertaken. The benefits of urban renewal will vary from project to project area. Redevelopment must always serve a public purpose to warrant the investment of public funds. Below is a list of the benefits of urban renewal in Pueblo.

-

Elimination of Blight.

- The state law authorizing urban renewal authorities was passed to address a very specific problem—slums and blighted areas. In the law, the state General Assembly called these areas a “serious and growing menace, injurious to the public health, safety, morals and welfare” of residents. The acquisition of properties and the elimination of their slum or blighted character are considered a public purpose under state law, justifying the expenditure of public funds. Furthermore, elimination of blight is one of the key public benefits of urban renewal in Pueblo.

-

Creation of New Sources of Tax Revenue.

- Redevelopment puts non-producing or under-producing properties back on the tax rolls. Initially, the additional taxes created by the redevelopment area are used to help fill the gap between the total cost of a redevelopment project and the level of private financing it can support. Once the monetary obligations related to a project are fulfilled, the taxing entities have new, permanent sources of revenue that wouldn’t have existed if the project hadn’t been undertaken. Declining property values and diminishing retail sales, which usually accompany blight, would have resulted in reduced tax collections and increased demands for governmental services without redevelopment.

-

Creation of Jobs.

- Redevelopment creates new jobs, both temporary during the construction phase and permanent jobs once a project is complete. These jobs range from entry-level service positions to higher-paying management roles.

-

Creation of Public Infrastructure, Schools, and Parks.

- TIF revenues must be used for a public purpose, generally, infrastructure improvements associated with the redevelopment. These include site acquisition and clearance; construction and/or reconstruction of streets, water and sewer systems; and removal of hazardous materials or conditions. TIF revenues also are used to build schools, parks, and other community facilities.

-

Creation of Housing.

- Redevelopment projects help increase and improve the city’s housing stock. Some PURA projects have created both market-rate and affordable housing.

-

Improved Quality of Life.

- Although difficult to measure, there are many intangible benefits of redevelopment that fall loosely into the category of “improved quality of life.” Redevelopment projects can allow residents to live near where they work, spending less time shopping and commuting to jobs. They can help reduce the crime rate and improve its overall beauty, boosting property values and making it safer and more desirable to live in.

-

Reduction of Pollution/Environmental Contamination.

- In older industrial areas, serious environmental contamination makes redevelopment cost-prohibitive for developers. Often it is easier for a developer to buy clean land than to pay for the cleanup of a contaminated site. With PURA’s assistance, these brownfield sites can be cleaned up and returned to productive use. Redevelopment can lead to reduced air pollution if the project includes a pedestrian orientation and is designed around existing transit stations. Because residents can live, shop, and socialize in their immediate neighborhoods, or take public transportation to other parts of the city, dependence on the automobile and traffic congestion is reduced.

-

Prevention of Urban Sprawl.

- Redevelopment provides an alternative to urban sprawl by allowing infill development and adaptive reuse of inner city sites that have ceased to function in the use for which they were intended.

-

Provision of Retail in Underserved Areas.

- While many people take for granted the ability to buy groceries, get a haircut, or get clothes dry-cleaned near their homes, residents of older, less affluent neighborhoods often don’t have these amenities nearby. One of the benefits of urban renewal in Pueblo is revitalizing retail in the underserved areas of the city.

-

Historic Preservation.

- Preserving Pueblo’s historic buildings has been a long-standing goal of the city, and PURA’s redevelopment efforts have contributed to achieving that goal. The willingness of visionary developers to reuse older buildings, combined with the financial incentives that make such redevelopment feasible, have helped the city preserve its heritage for future generations to enjoy and appreciate.

My neighborhood is not in decline. How does urban renewal affect me?

The urban renewal law was passed in recognition of the fact that the adverse impacts of distressed areas tend to be contagious. Even though a neighborhood may be prosperous, deteriorated areas in the overall community can still physically and financially have an impact on surrounding neighborhoods. Following is a list of negative impacts blighted areas may have on healthy neighboring areas:

-

Deteriorating areas cannot pay their own way.

- People who live in deteriorated and overcrowded conditions are often the victims of crime and unsafe living conditions. These deteriorating areas require more public services, such as public safety, than the tax revenue produced in the area can fund. When that happens, funding is diverted from other public services. Therefore, deteriorated areas may be a financial drain on the entire community.

-

There are no natural barriers to deterioration.

- If not controlled, deterioration tends to spread, spilling over into adjacent areas and affecting an ever-widening circle of surrounding residents and businesses. As with any malady, a swift recovery is more likely if the causes and symptoms of deterioration are treated early.

-

Deterioration results in an economic drain on the community.

- As offices, industries, services, and shops leave or close, jobs and tax revenues are lost. The relocation of one business outside the area encourages other firms to leave, causing a ripple effect on the community. Vacated residential and commercial structures are an economic drain on the neighborhood as property depreciates or stagnates. If the deterioration continues, shopping areas and jobs move farther and farther away, stranding the transit-dependent and causing those with automobiles to travel farther for work and the basic necessities of life. Residents then spend more money and travel farther to find employment, shopping, and recreation outside their neighborhood.

-

A deteriorating area results in a negative image that affects development elsewhere in the community.

- What a community has to offer in terms of labor, land, consumers, facilities, transportation, and environment plays a major role in business location decisions. If a community does not stop deterioration and turn it around, new businesses will not choose the community as the site for new development. Therefore, a decaying neighborhood is a major deterrent to new investment.

How does redevelopment benefit our local schools and libraries?

As a project area is revitalized, it begins to generate enough revenue to pay its own way and contribute to other areas of the community. When a redevelopment project ends, the property taxes from the increase in property values flow to all other local taxing agencies (such as special districts, counties, school districts, drainage, flood control districts, etc.) Furthermore, increased sales tax revenues also enable local governments to provide greater public safety and services to all citizens while stopping the spread of deterioration and blight.

Will my community lose the good qualities it already has if PURA pursues urban renewal in Pueblo?

The financial structure of redevelopment funding (tax increment) is designed to target and fund only areas that need redevelopment. Consequently, healthy areas of the community likely will not be targeted.

How does PURA make the decision to invest in a redevelopment project?

If a redevelopment project can be accomplished without public investment, PURA does not get involved. A public/private partnership often is required to accomplish the redevelopment of deteriorating urban properties because they are more difficult and expensive than new development on raw land. Lastly, TIF is used to level the playing field so that developers will find urban settings as attractive as suburban sites.

Financing Redevelopment

How Is Redevelopment Financed?

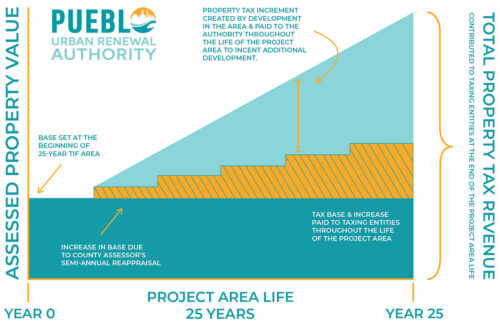

The primary tool used in Pueblo and throughout the state to finance redevelopment efforts is tax increment financing (TIF). TIF, the net new tax revenues generated by a redevelopment project is used to fill the gap between the total cost of a project and the level of private financing the project can support.

How does TIF help redevelopment?

TIF enables redevelopment agencies like PURA to pledge tax increments generated by redevelopment to pay off bonds or reimburse developers for eligible project costs if the project brings in new revenue. In either case, TIF revenues generally are used for improvements associated with the benefits of urban renewal in Pueblo, including site acquisition and clearance; construction and/or reconstruction of streets, utilities, parks, or other public infrastructure; and the removal of hazardous materials or conditions.

How does TIF work?

Under this financing mechanism, the level of property and/or municipal sales tax collections in a project area before redevelopment is set as a base. The new tax revenues expected to be generated are estimated. The difference between the base and the increased taxes collected due to the redevelopment project constitute the “tax increment.” The base, adjusted every two years in connection with the reassessment process, continues to be paid to the normal taxing entities. Lastly, the increment is used for a specified period of time to pay off bonds or to reimburse a developer for a portion of their costs.

Where does PURA get the authority to use TIF?

Urban renewal authorities (URAs) are authorized by state law to use TIF. The authorization is contained in the Colorado Urban Renewal Law.

Are there any special requirements for using TIF?

Yes. TIF may only be used for redeveloping an area that is blighted. Furthermore, this is based on criteria contained in state law (see Section 1 for blight criteria).

How is the level of TIF funding for a project determined?

The amount of TIF varies from project to project. In order to determine the level of TIF funding a project is eligible for PURA typically uses the lesser of three amounts. This includes the financing gap, the TIF capacity of the project (how much sales and/or property tax increment it is expected to generate), or the eligible costs.

How long can TIF be used for a redevelopment project?

The length of time in which TIF may be used in a project is tailored to each specific project. The maximum length of a TIF project area is 25 years, but many have shorter durations. Lastly, once the monetary obligations are fulfilled, the increased revenues revert to the normal taxing entities.

Do property taxes increase to pay for a redevelopment project?

No. Property tax increment revenues are the result of any rise in property values due to redevelopment, not an increase in tax rates.

Do taxing entities serving a redevelopment project area lose tax revenue?

No. Taxing entities such as Pueblo City Schools, Pueblo City and County Library, and special districts continue to receive all the tax revenues they received the year a redevelopment project started (the base year). Over the long term, they benefit from the redevelopment project and the tax increment financing process. Once PURA’s financial obligation is repaid, they receive all the tax increment created by the redevelopment that PURA had been using to repay bonds or reimburse developers.

The Redevelopment Process

Every redevelopment project in which PURA is involved, by its nature, is difficult. If a proposed project did not have problems—financial, physical, or market-driven—the private sector would be able to accomplish the redevelopment on its own and there would be no need for PURA assistance.

PURA becomes aware of potential projects in a number of ways. Projects may be brought to the authority’s attention by city leaders, neighborhood groups, or developers. Sometimes, redevelopment is part of a city policy directive.

Once PURA has a proposed project, the authority follows a structured process to take a redevelopment from concept to reality.

You can join our meetings or read previous minutes to learn more about our current and upcoming projects.

What is the first step in the redevelopment process?

The first step is to conduct a blight study. This is performed by consultants skilled in conducting blight studies.

A blight study has a two-fold purpose. The first is to determine whether PURA can become involved in a project. The second is to help establish the boundaries of the urban renewal area. Moreover, the boundaries used for the blight study become the boundaries for the urban renewal area. In no circumstance may the urban renewal area boundaries be set outside the boundaries of the blight study area.

What happens after the blight study?

If blight is found, the next step in the process is developing a redevelopment plan. This will provide a legal framework for implementing redevelopment activities in a project area.

Who approves the redevelopment plan?

A redevelopment plan is approved at public meetings by both the PURA Board of Commissioners and the Pueblo City Council.

Are projects subjected to any kind of design review?

Yes. PURA participates in a design review process, frequently in conjunction with the Planning Office and other city staff. Furthermore, the purpose of the review is to ensure that any redevelopment project fits into city planning objectives.

Who authorizes the use of TIF for a project?

The Pueblo City Council approves the redevelopment plan.

Is there any kind of agreement between PURA and the developer?

Yes. Once the City Council has approved the redevelopment plan, PURA negotiates a redevelopment agreement with the developer. Furthermore, this document includes a description of the project, the budget, the tax increment usage, and a performance schedule.

At what point can I have input into the redevelopment process?

There are several points at which the public can have input into the redevelopment process. People who reside, own property, or have a business in a neighborhood have the biggest stake in a redevelopment project. For that reason, a developer may seek neighborhood input on a project before coming to PURA for assistance.

Once PURA has been asked to be involved in redevelopment, it creates a presentation for the neighborhood in that area. The purpose of these presentations is to explain the project and seek input from the neighborhood. Moreover, members of the public also have the opportunity to attend PURA Board meetings. This allows them to hear discussions on a project and the benefits of urban renewal in Pueblo.

When a redevelopment plan reaches City Council for approval, the public has another formal opportunity to comment on the plan. The state Urban Renewal Law requires a public hearing on every plan before the City Council takes action. The public notice is given 30 days before the hearing in a general circulation newspaper. All residents, property, and business owners with concerns in the redevelopment area, must receive written notice of the public hearing.

NOTICE UNDER THE AMERICANS WITH DISABILITIES ACT

NOTICE UNDER THE AMERICANS WITH DISABILITIES ACT

In accordance with the requirements of title II of the Americans with Disabilities Act of 1990 (“ADA”), the Pueblo Urban Renewal Authority will not discriminate against qualified individuals with disabilities on the basis of disability in its services, programs, or activities.

Employment: The Pueblo Urban Renewal Authority “the Authority” does not discriminate on the basis of disability in its hiring or employment practices and complies with all regulations promulgated by the U.S. Equal Employment Opportunity Commission under title I of the ADA.

Effective Communication: The Authority will generally, upon request, provide appropriate aids and services leading to effective communication for qualified persons with disabilities so they can participate equally in the Authority’s programs, services, and activities, including qualified sign language interpreters, documents in Braille, and other ways of making information and communications accessible to people who have speech, hearing, or vision impairments.

Modifications to Policies and Procedures: The Authority will make all reasonable modifications to policies and programs to ensure that people with disabilities have an equal opportunity to enjoy all of its programs, services, and activities. For example, individuals with service animals are welcomed in the Authority’s offices, even where pets are generally prohibited.

Anyone who requires an auxiliary aid or service for effective communication, or a modification of policies or procedures to participate in a program, service, or activity of the Authority, should contact the office of the Authority as soon as possible but no later than 48 hours before the scheduled event.

The ADA does not require the Authority to take any action that would fundamentally alter the nature of its programs or services or impose an undue financial or administrative burden.

The Authority will not place a surcharge on a particular individual with a disability or any group of individuals with disabilities to cover the cost of providing auxiliary aids/services or reasonable modifications of policy, such as retrieving items from locations that are open to the public but are not accessible to persons who use wheelchairs.